The Only Funding Where the Top Lenders Compete to Earn Your Business with the Best Offer

Don't trust just anyone with your business funding.

We consult, not sell—so you fund with confidence, not regret.

When the bank says no, you still have options.

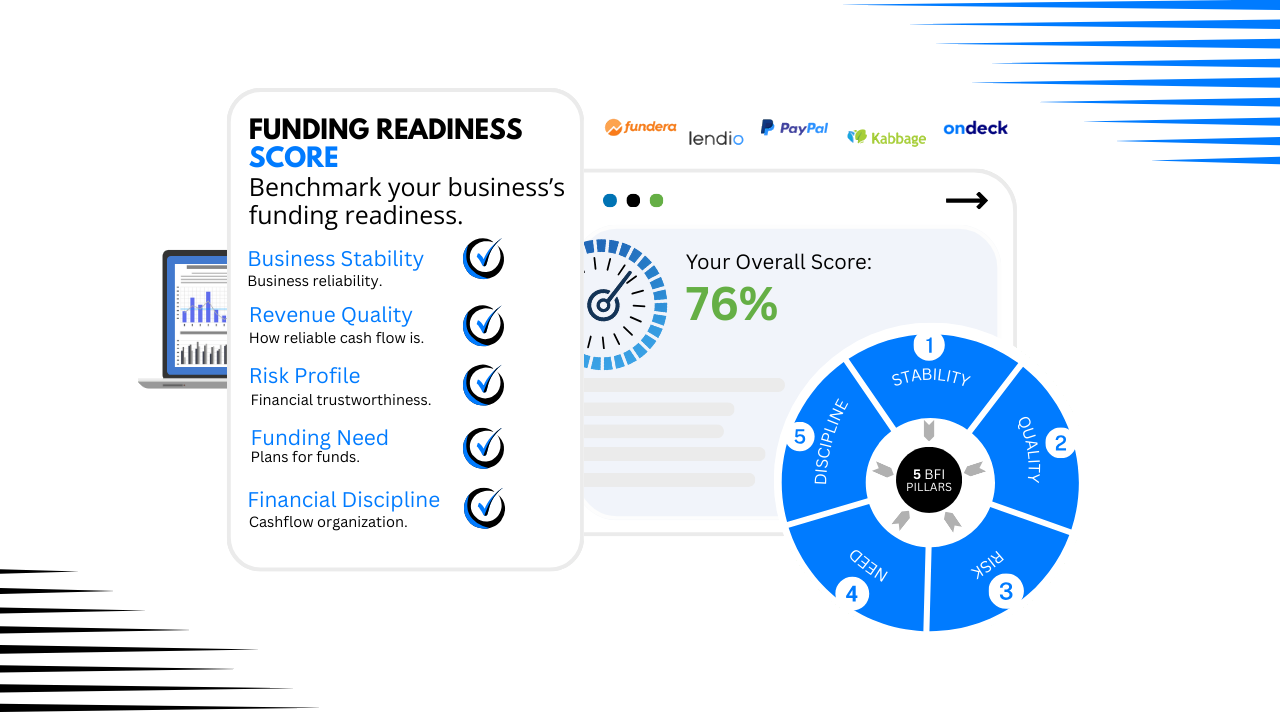

Many small business owners think they need funding — when what they really need first is clarity on how fundable their business actually is. Our quick funding readiness check evaluation can show where you stand with lenders and what, if anything, needs to improve before moving forward.

Start My Funding Readiness Check

Start My Funding Readiness Check

Funding made simple

Request Quote

Our funding broker will give you a free, no-obligation quote at your convenience.

Receive Best Offer

Unlock lender-only offers from 20+ top competitors — guaranteed and never publicly listed. Because we don’t work for the lenders. We work for you.

Fast Funding

Avoid the hassle of a long approval wait. We can fund as quickly as 1 day.

MEET ONE OF THE LOCAL FUNDING AGENTS IN YOUR AREA

Connect with a local expert who’s here to help.

For over a decade, our leading industry lenders have helped small business owners like you

secure fast, flexible funding better than anyone else — so you can feel the relief of cash

in hand when you need it most without the stress!

When to work with 1-800 Biz Funds™

Cash Flow Gaps

Expansion & Growth

Equipment Upgrades

Slow Bank Approvals

Seasonal Slumps

Get Ready for Fast, Hassle-Free Funding—Here’s What Happens Next

The 1800 Biz Funds® Advantage

Get the Best Deal—Guaranteed! With our one-stop shop funding solution, you gain access to 20+ lenders, ensuring you receive the best possible offer tailored to your business needs. Plus, we back it with a $500 guarantee, giving you confidence that you're making the right choice—risk-free.

Why We Do a Consult First (And Why That Matters)

We’re not a funding mill that spits out quotes without context, we're a red carpet education first consulting service.

If you’re just looking for the fastest number with no questions asked, we’re probably not the right alternative lender for you — and that’s okay.

At 1800 Biz Funds, we start with a quick consult with one of our certified agents because we believe smart funding starts with a smart conversation.

We want to understand your goals, your challenges, and your cash flow so we can help you avoid the common debt traps that put so many business owners in a worse spot.

We don’t just aim to get you funded.

If you want a strategic partner, not just a payout, you're in the right place.

Fast. Simple. Competitive. The Smarter Way to Fund Your Business!

At 1800 Biz Funds™, we’re committed to helping business owners thrive. That’s why we’ve created—your all-in-one solution for securing funding from 20+ top lenders with just one application unlike our competitors. More competition means better approval odds and the best repayment terms for you!

Small Business Funding FAQ's

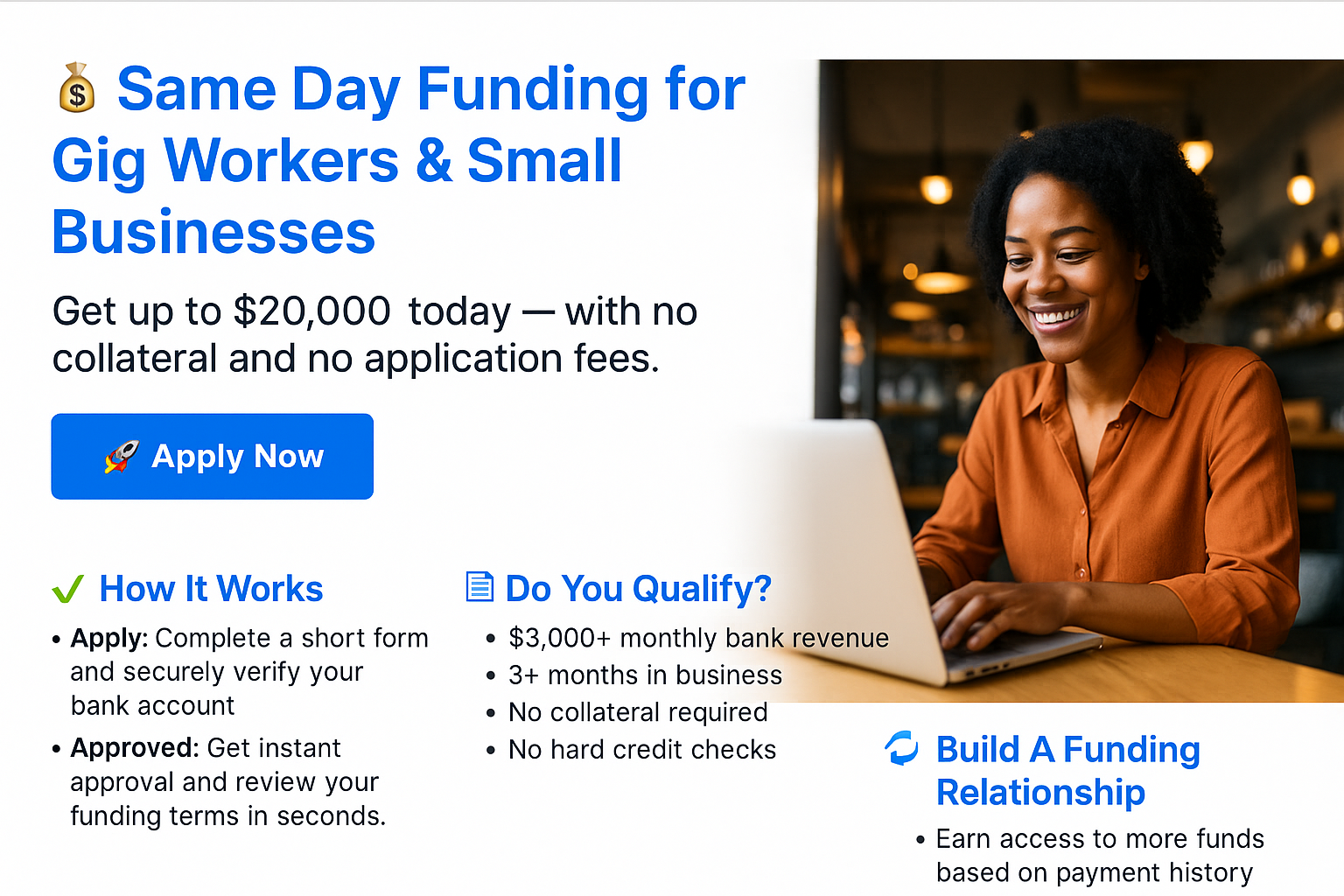

Minimum Requirements:

• $15,000+ monthly revenue (last 3 months)

• Business checking account

• 550+ FICO score

• Limited NSF/zero balance days

Example: $50,000 in revenue could get you $25,000–$100,000 in funding.

Our funding = $35,400–$45,000 payback — but faster, no collateral, no red tape.

You’ll always know: “I borrowed this much. I’m repaying this much.”

No games. No hidden APR traps.

Our lenders don’t provide long-term loans because our clients aren’t required to put up collateral like a house or have a high credit score. That’s why we focus on value first and cost second.

A traditional bank might offer lower-cost loans, but the trade-off is significant. You risk your house or business, go through weeks of paperwork, and many still get denied.

We believe we offer better value because we help business owners move fast, stay safe, and grow — without risking everything they’ve built.

So if you’re more of a cost-sensitive borrower than a value-sensitive one, you may be better off applying with a traditional bank.

Top 10 Reasons Small Business Owners Get Denied Funding

1. 🚫 Low Monthly Revenue

Most lenders require $3K–$15K/month. Anything less = too risky.

2. 📉 Insufficient Time in Business

Less than 3 months in business? Most lenders won’t fund.

3. 💳 Negative Balances / Overdrafts

Too many NSFs or negative days signals poor money management.

4. 🏚️ Personal Credit Too Low

FICO under 500 may shut down many options.

5. 🏦 Limited Bank Activity

Sparse deposits or too much cash-only revenue makes lenders uneasy.

6. 🧾 High Existing Debt (Stacked Advances)

If you’ve stacked multiple advances, most lenders will say no.

7. 📅 Irregular Deposits

Gaps or inconsistency in deposits = high-risk borrower.

8. 💼 Non-Business Bank Account

Using a personal account instead of a business account disqualifies many. (If doing over 15k in sales per month.)

9. 🏷️ High-Risk or Restricted Industry

Some industries (cannabis, firearms, adult) are automatically excluded in most cases.

10. ⚠️ Altering Bank Documents

Submitting fake or edited statements is considered fraud and will blacklist you permanently.

Industries We Proudly Fund

- Construction: general contractors, home builders, renovation companies, and specialty trades.

- Retail: includes ladies, children & men clothing, jewelry, bakers, printing, ice cream shops, telecommunications, furniture stores, lighting companies, shipping or mail services.

- Healthcare: includes doctors, dentist, veterinarians, chiropractors, home healthcare facilities, individual home healthcare companies.

- Marinas: along with other related groups such as boating repair shops.

- Repair Shops: auto & truck repair (transmission, body shops, engine, glass, upholstery), appliance repair, watch repair, lawn mower repair, motorcycle or bike repair.

- E-commerce

- Metal Fabrication Shops

- Insurance: includes agencies with a larger book of business such as a State Farm agency or an independent agent.

- Accounting: this includes accounting firms that do more than seasonal tax preparations.

- Architects

- Education: includes education sales, childcare, daycare and schools.

- Dance Studios: including cheer and dance.

- Gyms

- Nail & Hair Salons (including Barbershops)

- Employment & Medical Staffing Agencies

- Medical Equipment Sales

- Bicycle Stores

- Pharmacies

- I.T and Computer Services

- Water Purification & Air Restoration Companies

- Massage Therapists

- Private Schools and Colleges

- Carpet Companies Sales & Services

Funding Your Business is Just the Start—Unlock More Opportunities for Growth!

Secure the funds your business needs today, and once you establish a consistent payment history, you may be eligible for additional funding—sometimes before the current advance is fully repaid.

Keep your business growing with ongoing funding options at your fingertips! Apply today!

Who We Are

1-800-BIZ-FUNDS is the independent marketing and distribution team I founded under the DAC/Bank Breezy licensed broker framework. I’m Ben Thimas Jr., an entrepreneur based in Southeastern Massachusetts. I was raised by a hardworking small-business owner, and today my wife Michelle and I care for my retired mother at home. Those experiences shaped my mission: to elevate the financial well-being of small business owners in communities like ours.

Growing up, I watched my mother hustle day and night to keep her business afloat — without access to the capital or support that big corporations take for granted. Like most Main Street owners, she couldn’t qualify for traditional bank loans. And lack of funding is the #1 reason small businesses fail. When small businesses fail, America fails.

Years later, as an eCommerce retailer, I found myself facing the same struggle. I was profitable, but still couldn’t get the funding I needed to buy more inventory and scale. Banks wanted collateral, perfect credit, and hoops that most real entrepreneurs simply can’t jump through. It was frustrating and discouraging to realize that even success didn’t guarantee support from the traditional banking system.

That experience changed me. I decided to partner with a leading lending platform and build a referral-based funding agency that educates and connects small business owners with the capital they need to grow. I know exactly what it feels like to run a good business, create real profits, and still be told “no” by a bank.

That’s why I launched 1-800-BIZ-FUNDS — a grassroots, decentralized small business funding agency designed for the real world of Main Street. Just like realtors represent homeowners, I represent small business owners, helping them access 20+ top alternative lenders and real underwriting experts who understand their needs beyond a credit score.

I act as an education-first marketing affiliate for trusted lenders — but I’m not here to push debt. I’m here to protect the financial interests of small business owners and help them navigate the funding landscape with confidence, clarity, and support.

For me, this isn’t theory. This is personal. Helping small business owners access the capital they need isn’t just what I do — it’s my passion and obsession.

Thank you for reading my story.

What Makes Us Different

✔ Decentralized by design: We’re not locked into one lender or one structure — we work across multiple platforms to get small businesses funded fast, without the red tape at the best terms available in the market.

✔ Borrower-first mindset: We understand what it’s like when cash flow is tight, banks say no, and payroll is due — and we also understand that borrowing money comes with real risk.

✔ Profit-sharing opportunity: Our clients don’t just get funded — they get the chance to become paid referral partners and earn income simply by helping other small businesses do the same.

What You Get With Us

- Up to $2 million in fast funding

- No collateral, no credit score obsession

- A simple, no-cost application

- Real support from real people who get it

We’re not bankers.

We’re not Wall Street.

We’re Main Street funding Main Street — and that makes all the difference.

Join Our Back Mainstreet Movement Collective

Agent Opportunities Available

Click 👉 1-800-BIZ-FUNDS!

Click 👉 1-800-BIZ-FUNDS!

Apply to become a 1-800 Biz Funds Agent by taking our agent screening evaluation and get paid for helping small businesses access funding.